In a striking turn of events, the Australian casino operator, Star Entertainment Group Ltd., has openly acknowledged its precarious financial state. The company is grappling with significant liquidity challenges and faces uncertainty about its future as a viable business. Exploring various avenues to improve its financial position, Star has encountered limitations in raising the necessary funds to secure its operations. Without substantial improvements, there are doubts about the company's ability to continue operating. This situation highlights the mounting pressures on the company, which has been embroiled in scandals since late 2021.

Detailed Report on Star Entertainment Group's Financial Crisis

In the heart of Australia's bustling casino industry, Star Entertainment Group Ltd. finds itself at a critical juncture. On a recent Monday, the company issued a stark warning: it is exploring multiple strategies to enhance its liquidity but faces severe constraints. Specifically, it struggles to raise AUD 150 million in subordinated debt, a crucial condition for accessing an additional AUD 100 million in borrowing. This financial shortfall casts a shadow over the company's sustainability.

The company reported having AUD 78 million in available cash by the end of 2024, marginally lower than the AUD 79 million disclosed earlier. Revenue for the quarter ending December 31, 2024, saw a 15% decline from the previous quarter, totaling AUD 299 million. Earnings before interest, taxes, depreciation, and amortization (EBITDA) revealed a loss of AUD 8 million, underscoring the ongoing operational weaknesses.

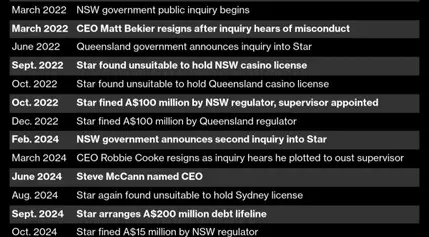

Star's troubles began in October 2021 when allegations surfaced regarding the company's involvement in money laundering, organized crime, and fraud. Subsequent regulatory inquiries deemed Star unfit to operate its Sydney and Queensland casinos, leading to government supervision. These developments have wiped nearly AUD 4 billion from the company's market capitalization, leaving it valued at approximately AUD 390 million. Shares fell 3.6% to 13.5 cents in early trading on Monday.

From a journalist's perspective, this situation serves as a cautionary tale about the importance of corporate responsibility and transparency. Star Entertainment Group's struggle highlights the severe consequences that can arise from failing to adhere to stringent regulations and ethical standards. It underscores the need for companies to prioritize integrity and compliance to ensure long-term stability and trust in their operations.